32+ payroll tax calculator oklahoma

Your average tax rate is 1167 and your marginal tax rate is 22. Add W-2 employees at any time.

Best Prestashop Modules For Prestashop 1 7 1 6 Prestashop 1 7 Modules

Free for personal use.

. Over 700000 Businesses Utilize Our Fast Easy Payroll. This marginal tax rate means that your. Hourly employees who work overtime.

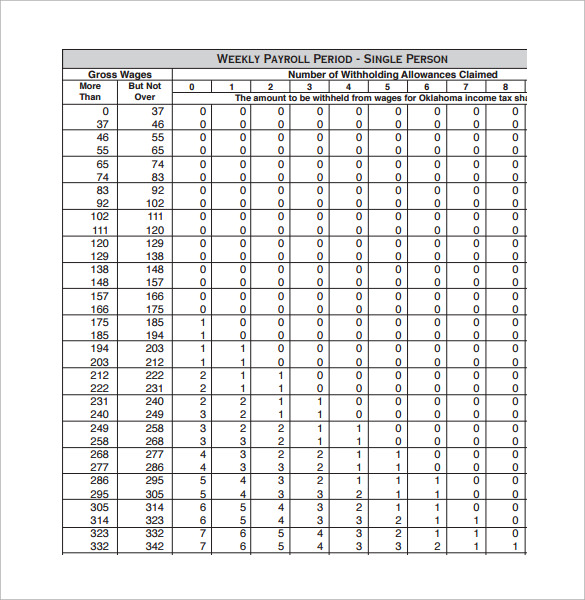

Web With six marginal tax brackets based upon taxable income payroll taxes in Oklahoma are progressive. All Services Backed by Tax Guarantee. Supports hourly salary income and.

This free easy to use payroll calculator will calculate your take home pay. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Oklahoma. Web Optional Select an alternate tax year by default the Oklahoma Salary Calculator uses the 2023 tax year and associated Oklahoma tax tables as published by the IRS and.

Web Calculate your Oklahoma net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Free Unbiased Reviews Top Picks. Tax rates range from 025 to 475.

It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Enter your info to see your take home pay.

Well do the math for youall you need to. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Web SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Ad Compare This Years Top 5 Free Payroll Software. Ad Well file your 1099s new hire reports. Web The minimum wage in Oklahoma is whatever the minimum wage is at the federal level which is currently 725 per hour.

Figure out your filing status work out your adjusted. Web If you make 55000 a year living in the region of Oklahoma USA you will be taxed 11198. Single filers will pay.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Add W-2 employees at any time.

Web If you make 70000 a year living in Oklahoma you will be taxed 10955. Web Payroll check calculator is updated for payroll year 2023 and new W4. Web Oklahoma Paycheck Calculator.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Sign Up Today And Join The Team. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

That means that your net pay will be 43803 per year or 3650 per month. Learn About Payroll Tax Systems. Web Salary Paycheck Calculator Oklahoma Paycheck Calculator Use ADPs Oklahoma Paycheck Calculator to estimate net or take home pay for either hourly or salaried.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. 905 Asp Avenue Room 244 Hours of Operation Lobby Hours. Ad Well file your 1099s new hire reports.

Monday - Friday in accordance. Web Calculating your Oklahoma state income tax is similar to the steps we listed on our Federal paycheck calculator. Boost Your Business Productivity With The Latest Simple Smart Payroll Systems.

Free 31 Calculation Forms In Pdf Ms Word

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

Free Income Tax Filing Portal In India Eztax

How To Calculate Payroll Taxes Wrapbook

Best Prestashop Modules For Prestashop 1 7 1 6 Prestashop 1 7 Modules

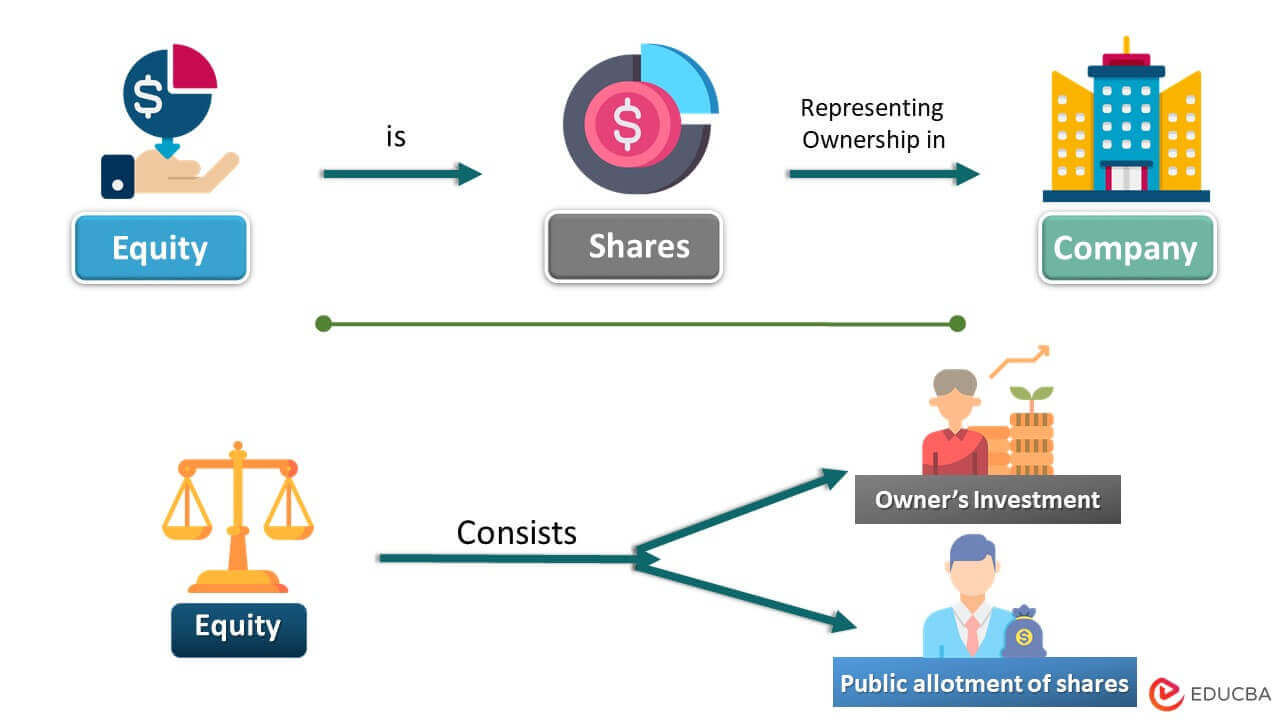

Equity Meaning Formula Examples Calculation Importance

The Fluent Show Podcast Addict

Customer Loyalty

Oklahoma Income Tax Calculator Smartasset

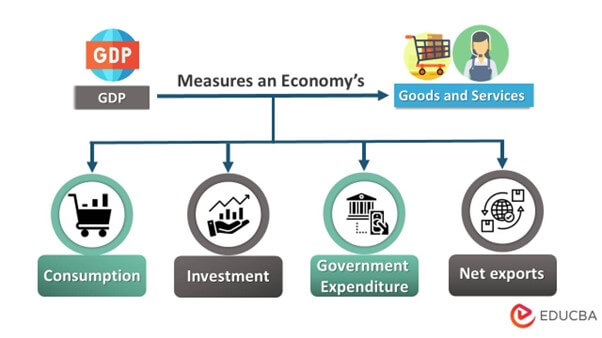

Gdp Gross Domestic Product Meaning Formula Excel Examples

Bonus Depreciation Definition Examples Characteristics

How To Calculate Payroll Taxes Wrapbook

Econ1202 Notes Econ1202 Quantitative Methods A Unsw Thinkswap

How To Calculate Payroll Taxes Wrapbook

How To Calculate Payroll Taxes Wrapbook

How To Calculate Payroll Taxes Wrapbook

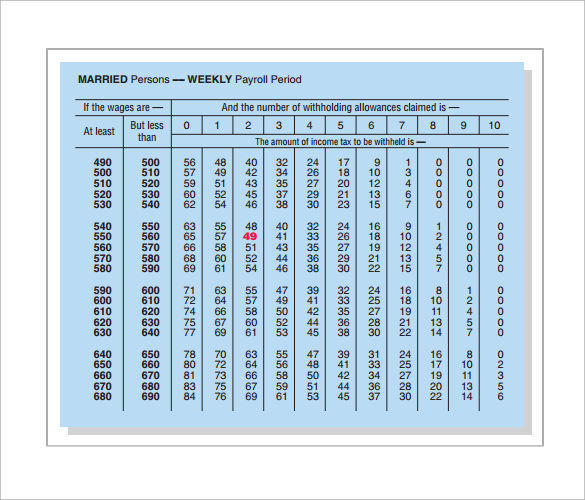

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel